To stay competitive as a tech founder, keeping up with the most recent advancements in payment processing technology is essential. The tech community is very excited about Apple Pay Later, a new payment service that they recently announced.

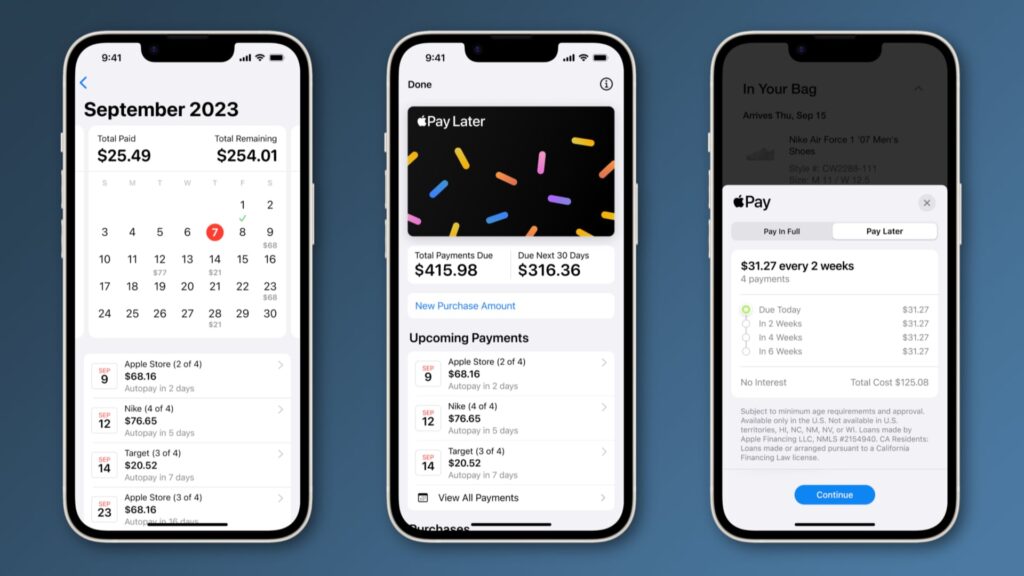

This innovative payment service allows customers to pay for installments, with interest-free periods of up to six months. In this article, we will explore how a tech founder can take leverage of Apple Pay Later to improve their current SaaS product development.

Table of Contents

Boost Conversions with Flexible Payment Options

Offering flexible payment options is a proven way to boost conversions and drive sales. With Apple Pay Later, customers can spread out their payments for purchases, making larger purchases more accessible to those who might not have cash for a single large payment. As a tech founder, incorporating Apple Pay Later into your payment processing system can help you tap into this market of customers looking for flexible payment options.

Increase Customer Loyalty with Interest-Free Periods

Another way a tech founder can leverage Apple Pay Later is by offering interest-free periods to their customers. Doing this allows you to win over more clients and foster lasting relationships with them. By incorporating Apple Pay Later into your payment processing system, you can offer your customers interest-free periods of up to six months. This can be a powerful tool for attracting and retaining customers because it demonstrates that you are willing to go above and beyond to meet their needs.

Streamline Payment Processing with Apple Pay Integration

In addition to providing flexible payment options and interest-free periods, integrating Apple Pay into your payment processing system can help your customers with the checkout process.

Apple Pay is a quick and secure payment method that allows customers to make purchases with their Apple devices.

By incorporating Apple Pay into your payment processing system, you can provide a more seamless checkout experience for your customers, increasing customer satisfaction and improving the overall user experience of your SaaS product.

Utilize Apple’s Powerful Brand and Reputation

Apple is a brand that is synonymous with innovation and quality, and a tech founder can benefit greatly from leveraging its strong brand and reputation. By incorporating Apple Pay Later into your payment processing system, you can leverage the trust and credibility of the Apple brand. This can be especially beneficial for startups or smaller businesses that do not yet have a market reputation.

Innovative Payment Solutions can help you stay ahead of the competition.

Finally, incorporating Apple Pay Later into your payment processing system can help you stay ahead of the competition by providing your customers with innovative payment options.

Staying up to date on the latest developments in payment processing technology is critical for a tech founder to remain competitive in the market. Incorporating Apple Pay Later into your payment processing system allows you to differentiate yourself from the competition and position your SaaS product as an innovative and forward-thinking solution.

Conclusion

In conclusion, incorporating Apple Pay Later into your payment processing system can provide numerous benefits for a tech founder looking to improve their SaaS product development. From boosting conversions and increasing customer loyalty to streamlining payment processing and leveraging Apple’s strong brand and reputation, the advantages of this innovative payment service are clear.

Staying ahead of the curve and leveraging the latest technology is critical for a tech founder to succeed in the competitive tech industry, and Apple Pay Later can help you achieve that goal.