Financial service providers are increasingly using technology to reach more customers. They’re also using it to deliver better services. From online payments to complex investment solutions, everything is now accessible online.

This evolution reflects changing customer demands. Delivering a seamless and secure digital experience is now paramount. There’s no room for error, as it could lead to financial losses and a crack in reputation.

This is where digital assurance testing powered by intelligent test automation (ITA) comes in. It helps address the security and stability of critical digital financial systems. It also helps safeguard customer information and financial assets within the application.

This blog explores the benefits of intelligent test automation for financial services providers. You’ll also discover how to address the challenges associated with its implementation.

Understanding intelligent test automation

ITA uses artificial intelligence (AI) and machine learning (ML). It helps:

- Make automation more stable

- Write test scripts

- Generate analytics for more efficient debugging and decision-making

Traditional test automation relies on predefined scripts and scenarios. But intelligent test automation can adapt and learn from data. It can improve its accuracy and effectiveness over time. This capability helps in the dynamic and complex environment of financial services.

5 benefits of intelligent test automation for financial services

Intelligent test automation brings a lot of advantages. Here’s how it benefits the financial services sector.

- Efficiency on autopilot

Manual testing can be slow and takes time. It’s also prone to human error. Intelligent automation can streamline the process to execute tests with speed and consistency. This frees up the budget for innovation, customer service enhancements, and regulatory compliance.

- Precision like never before

AI-powered tools constantly learn and evolve by analyzing past test results and patterns. This allows them to uncover nuances that might escape manual testing. It leads to more accurate and comprehensive testing across the board.

- Robust security

Protecting sensitive financial data is essential. Intelligent automation can automate security testing, scrutinizing systems for vulnerabilities proactively. This helps identify and fix potential security leaks, securing data and financial assets.

- Faster than the speed of business

Amid increasing competition, financial businesses are under pressure to release new features frequently. Intelligent automation boosts release cycles by cutting testing time. This translates to quicker launches of new features, updates, and security patches.

- Cost-effectiveness at its core

Replacing manual testing with intelligent automation can save you money. Here are the three factors that contribute to substantial cost savings.

- Reduced testing time

- Fewer resources

- Minimized errors

This frees up money to invest in customer experience, technology, and employee training.

Tailored applications for financial services

Intelligent test automation isn’t a one-size-fits-all solution. Here are specific applications it excels in within the financial services industry:

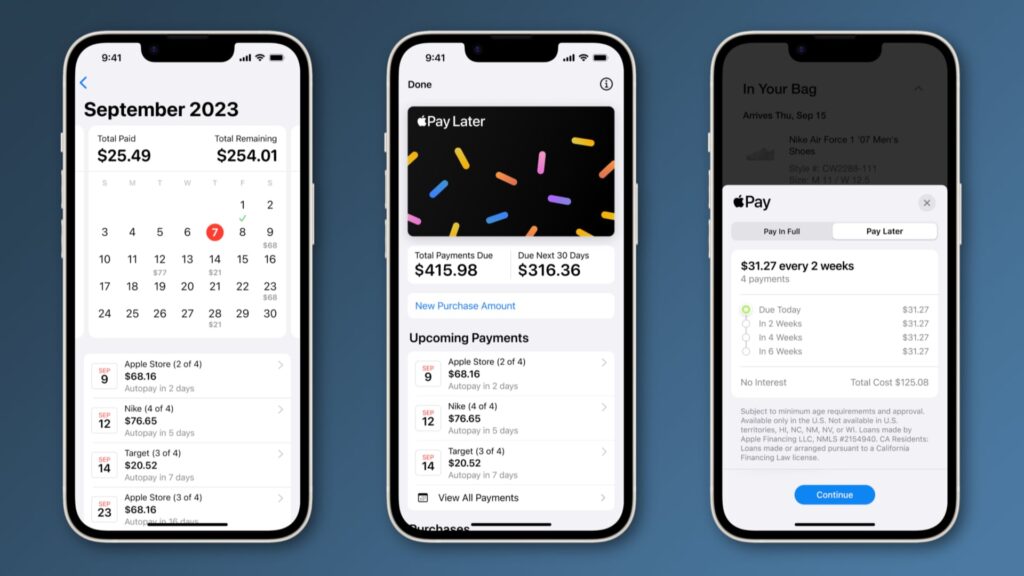

- Ensuring flawless mobile banking

Mobile banking is how most customers now conduct financial transactions and manage finances. ITA tests the functionality of apps across devices and operating systems. This contributes to a smooth, intuitive experience for users regardless of their device.

- Complying with confidence

Financial institutions operate within a complex regulatory environment. ITA tests financial applications and systems against these regulatory requirements. This helps ensure compliance. It also cuts the risk of fines, penalties, and reputational damage.

- Simulating stress and load

A surge in transactions shouldn’t overwhelm your system. It could lead to downtime and frustrated customers. Intelligent automation helps mitigate this risk by simulating stress and load scenarios. This allows you to identify potential bottlenecks and fix them. This helps ensure systems can handle peak volumes and unforeseen circumstances.

- Improving accuracy and reliability

The financial sector can’t afford to make mistakes. Errors in transactions, reporting, or compliance can lead to big financial losses. It can also damage your reputation. Intelligent test automation minimizes these risks.

ITA helps ensure applications and systems function correctly in various scenarios. It can identify and address defects, reducing the likelihood of errors reaching end-users. Also, intelligent automation learns from previous tests to predict and prevent future issues. It helps enhance the reliability of financial services.

Challenges of implementing intelligent test automation

Intelligent test automation offers undeniable advantages. But it’s important to acknowledge the challenges associated with its implementation:

- Upfront investment

Implementing ITA requires an initial investment in technology and resources. This includes spending on training, tools, and hiring experts in the field. But the long-term benefits outweigh the initial cost. They include:

- Cost savings

- Efficiency gains

- Improved risk management

You can adopt a phased approach. Or why not partner with an experienced quality engineering (QE) provider? Taking help from QE experts can help you overcome these challenges.

- Building expertise

Using the full potential of intelligent automation may demand training. It also requires expertise in specific tools and technologies. You can address this by:

- Investing in training programs for staff

- Partnering with experienced automation professionals

- Outsourcing specific tasks to specialized quality engineering companies

- Data, the fuel

The efficiency of intelligent automation depends on the accuracy of data. You need a robust data management strategy to ensure the quality and security of the data. This includes implementing proper:

- Data governance practices to ensure data accuracy, completeness, and consistency

- Data security measures to protect sensitive information from unauthorized access and misuse

- Data quality control procedures to find and fix any data errors or inconsistencies

Future outlook: the expanding role of intelligent test automation in financial services

The financial services landscape is undergoing a huge transformation. ITA can help drive secure, reliable innovation. It’s redefining the industry’s approach to efficiency, security, and customer service.

Here are the key trends and developments that will shape the role of ITA:

- Continuous evolution of AI and ML

As AL and ML continue to grow, ITA will become even more sophisticated. It will offer enhanced capabilities for testing and analysis.

- Integration with emerging financial technologies

ITA will test modern fintech innovations including blockchain and digital currencies. It will ensure these new platforms are reliable and secure from the outset.

- Enhanced decision-making with predictive analytics

By incorporating predictive analytics, intelligent test automation can give insights for better decision-making. It can help identify market trends and customer needs before they become the norm.

Conclusion

Intelligent test automation is transforming financial services. It helps increase efficiency, enhance accuracy, and strengthen security. By embracing this technology, financial institutions can:

- Deliver a superior customer experience by ensuring reliable and flawless digital services.

- Maintain a competitive edge by releasing new features and updates faster.

- Fix security flaws proactively.

- Create a future of trust and innovation by building confidence in the security and reliability of financial services.

The journey to embracing ITA may require investment and adaptation. But the rewards are many. It positions financial institutions as not just participants in the digital age but leaders shaping its progression.